Our experts frequently write blog posts about the findings of the research we are conducting.

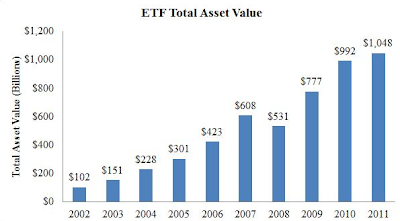

ETFs' Asset Value is Increasing, Trading Volume Remains Stable

Reserve your Clever ETF Ticker Before it's Too Late

But finding a catchy symbol can be tough these days. Many have already been taken: 1,350 symbols are in use on the NYSE Arca alone, the biggest U.S. market for exchange-traded products. That's up 108% over the past five years, says Ms. Morrison. In addition, fund firms have reserved 2,446 symbols for future...

Freddie Mac, complex derivatives, and one huge conflict of interest

President and CIO of Direxion admits that leveraged ETFs are not appropriate for most investors

The leveraged indexed ETFs are used by very tactical investors, and so there we have bull and bear funds. They have daily betas, which means that essentially...

FINRA Regulatory Notice: Complex Products

Futures-Based (Commodities) ETFs

Leveraged ETFs

Inverse ETFs

Introduction to ETFs

What are 'structured products', anyway?